%20(Facebook%20Post)%20(1).png)

Get a Cash Balance Plan illustration from one of our Cash Balance experts:

Why Cash Balance?

A Cash Balance Plan is the best way for attorneys to build wealth. With the help of a cash balance plan expert, a carefully designed plan can significantly lower taxes for doctors and practice owners. Such plans typically supplement a firm’s existing defined contribution (DC) program (401(k)/Profit Sharing) and provide all of the following advantages:

- Income deferral opportunities far beyond DC limits

- Flexibility around who is covered and what the contribution level is

- Tax-deductible contributions protect assets from creditors.

- Lump-sum payouts available for rollover or Roth Conversion

- Transparency regarding the cost of each participant’s benefit

So how much can you contribute?

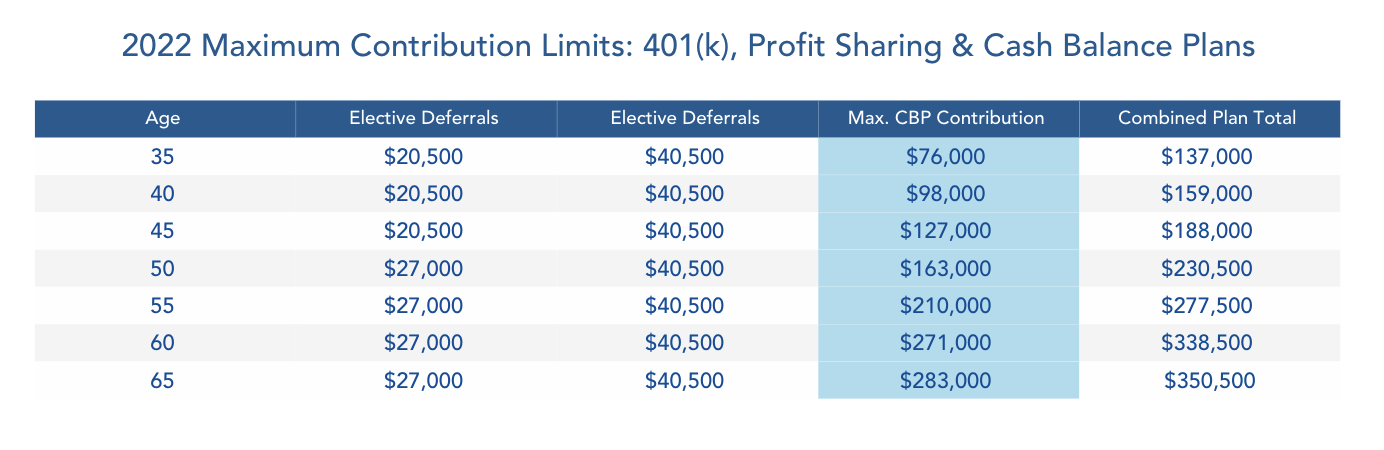

The final contribution amount depends on age and compensation levels but generally, a 50-year-old individual can contribute over $160,000 into this type of plan.

As displayed in the table below, the maximum Cash Balance Plan deferral opportunity increases with age. Coupled with the maximum DC amounts from elective deferrals and profit-sharing, the table shows the maximum deductible contribution opportunity available across all qualified retirement plans. While it may be appropriate for some key employees to have contributions at the highest levels, for others it may not. The flexibility built into the overall program is designed to meet the individual needs of each key employee.

Want to see if a Cash Balance plan could be right for you? A personalized CB Illustration will give you:

- Actual savings amounts you could contribute to the plan

- Any additional costs or requirements you will need to provide to staff employees

- Full picture of the benefit provided and next steps to implementation